Insurance Private Equity Fund

Insurance Private Equity Fund

PICC Capital Equity Investment Co., LTD. ("PICC Equity") is the only insurance private equity fund manager under PICC, and operates under PICC's "Excellent Insurance" overall strategy. It currently manages PICC Healthcare and Elderly Care Industry Investment Fund and PICC Shanghai Science and Technology Innovation Fund, striving to become a comprehensive insurance private equity fund management platform of "multi-fund, multi-industry, and multi-type LP". The company practices the investment philosophy of "Research-Driven, Insight into the Future, and Leading Change", with in-depth research to understands innovation, a forward-looking perspective to discover value, an influential investment to lead change, focuses on new technologies and strives to meet people's aspirations for a better life.

The PICC Healthcare and Elderly Care Industry Investment Fund was established in December 2018 with a total scale of 3 billion RMB. It focuses on healthcare sectors, targeting at biotech, medtech, medical informatization, healthcare service, etc., and aims to build an "Insurance + Health" ecosystem.

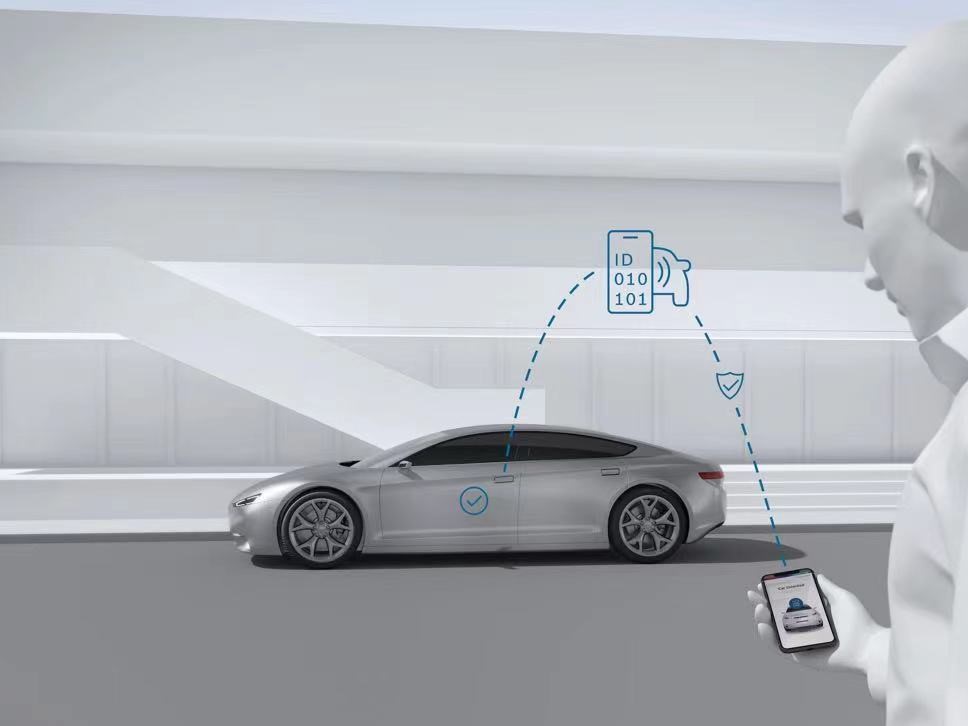

PICC Shanghai Science and Technology Innovation Fund was officially established in March 2020 by PICC, with a total scale of 3 billion RMB. It focuses on transportational sector investments , targeting at EV, new ICT, emerging infrastructure, new energy resources, etc., and aims to build an "Insurance + Technology" ecosystem.